Bridge Loans Made Easy with Georgia hard money lenders

Comprehending the Benefits and Threats of Hard Cash Loans for Real Estate Investors

Hard cash car loans present a special financing choice for actual estate capitalists. They offer fast access to capital with less constraints compared to conventional lendings. The attraction of rate comes with substantial risks, including high-interest rates and stringent repayment terms. Comprehending these dynamics is necessary for capitalists aiming to exploit on immediate opportunities. Guiding through the advantages and prospective mistakes will establish whether hard cash car loans are a sensible selection for their financial investment approach.

What Are Difficult Money Car Loans?

Difficult cash lenders are typically personal people or firms as opposed to traditional banks, allowing them to operate with more versatility relating to underwriting standards. Rate of interest on difficult cash loans tend to be higher contrasted to standard funding, reflecting the increased risk entailed. Georgia hard money lenders. Capitalists often transform to these loans when they require fast access to capital for getting, restoring, or turning buildings. Comprehending the nature of hard money car loans is crucial for investors looking for to leverage opportunities in the realty market

Key Benefits of Hard Money Loans

Hard money finances provide a number of benefits that interest genuine estate financiers. These financings offer fast accessibility to funds, allowing investors to confiscate chances without lengthy authorization processes. Additionally, adaptable financing criteria and short-term financing remedies make them an eye-catching choice for various financial investment techniques.

Quick Accessibility to Funds

Versatile Lending Standards

Genuine estate investors, flexible loaning requirements represent a significant advantage of difficult money fundings. Unlike standard financing options, which frequently rely heavily on credit rating and considerable paperwork, tough money lending institutions focus primarily on the worth of the home being funded. This technique allows financiers with less-than-perfect debt or restricted financial background to secure financing, making it easier to seek investment chances. In addition, hard money lending institutions may also consider the investor's experience and the residential or commercial property's potential for recognition rather than exclusively evaluating monetary metrics. This versatility can accelerate the finance approval procedure, allowing investors to act quickly in affordable realty markets. Such compassion in financing requirements is particularly advantageous for those seeking to exploit on time-sensitive bargains.

Temporary Funding Solutions

Actual estate investors frequently face time restrictions, temporary financing services like difficult cash financings give a practical option to meet immediate financing requirements - Georgia hard money lenders. These fundings are typically secured by the residential property itself, permitting capitalists to bypass prolonged typical loaning procedures. Approval can frequently take place within days, making difficult money finances excellent for time-sensitive deals such as turning homes or closing on distressed properties. The rate of funding enables investors to profit from financially rewarding chances that may or else be missed. Furthermore, these fundings can be tailored to match specific task timelines, offering adaptability in repayment terms. Overall, difficult money finances function as a crucial tool for capitalists seeking fast access to resources in an affordable realty market

Possible Drawbacks of Hard Money Loans

While tough money finances offer quick accessibility to capital, they include significant disadvantages that capitalists ought to consider. Specifically, high rates of interest can bring about substantial prices with time, while short repayment terms may press customers to generate fast returns. These elements can impact the overall feasibility of utilizing hard money car loans for genuine estate financial investments.

High Rate Of Interest

What variables add to the high rate of interest prices commonly related to difficult money car loans? Mainly, these prices show the danger profile that loan providers embark on. Tough cash lendings are usually provided by personal financiers or companies, which do not stick to typical financial laws. Consequently, they often money buildings that standard lending institutions could consider as well dangerous. Furthermore, hard cash lendings are normally temporary services, requiring greater rate of interest to make up for the fast turnaround. The speed of funding also contributes; lending institutions charge a lot more for the benefit and fast access to funding. Consequently, while hard cash financings can be useful for quick deals, the high rate of interest can considerably impact total financial investment returns, making mindful factor to consider vital for potential debtors.

Brief Settlement Terms

High rates of interest are not the only worry for borrowers taking into consideration hard cash lendings; brief repayment terms likewise existing considerable obstacles. Usually varying from a couple of months to a number of years, these terms can pressure debtors to generate fast returns on their investments. This seriousness may cause rash decision-making, causing less-than-optimal home acquisitions or poor remodellings. In addition, the impending deadline can create monetary pressure, as investors need to either secure refinancing or market the residential property within a limited duration. The risk of default increases under such problems, possibly leading to loss of the collateral. Subsequently, while tough money loans supply quick accessibility to funding, the short repayment terms can complicate a capitalist's economic strategy and overall success.

When to Think About Hard Cash Fundings

When is it prudent genuine estate capitalists to ponder tough money lendings? When conventional funding choices are impossible, such lendings are commonly taken into consideration. Financiers could look for difficult money fundings for fast accessibility to capital, especially in affordable property markets where prompt deals are important. They are especially useful in situations entailing troubled properties, where urgent remodellings are needed to boost value. Additionally, when an investor's credit rating is less than perfect, difficult cash fundings give an alternative path to funding. Capitalists may likewise discover these loans helpful for obtaining buildings at auctions, where prompt funding is needed. Moreover, for those aiming to leverage fix-and-flip possibilities or short-term financial investments, hard money finances can help with quick deals. Inevitably, the choice to utilize hard money lendings ought to be assisted by the specific financial investment approach and time-sensitive demands of the capitalist.

Just how to Select the Right Hard Money Lender

Selecting the appropriate tough money loan provider is fundamental genuine estate investors who choose to pursue this financing option. Investors ought to begin by looking into lenders' reviews and reputations to assure dependability. It is critical to confirm the lender's experience in the realty market, especially in the specific kind of investment being targeted. Assessing financing terms, consisting of interest prices, costs, and payment timetables, allows financiers to compare deals efficiently. Openness in communication is crucial; a great lender must conveniently address concerns and give clear descriptions of the loan procedure. In addition, evaluating the lending institution's funding rate can influence investment chances, as prompt access to capital is commonly essential. Finally, constructing a connection with a lender can assist in future purchases, making it useful to choose a lender who is not only professional however additionally recognizes the investor's demands and objectives.

Strategies for Successful Tough Cash Car Loan Investment

Successfully steering hard cash lending financial investments calls for a tactical method that makes best use of returns while lessening dangers. Capitalists should begin by carrying out extensive market research, determining locations with solid development possibility and targeting buildings that can yield high returns. Establishing a clear departure get more info method is crucial, whether via home resale or refinancing.

Furthermore, preserving a solid relationship with respectable difficult money lending institutions can assist in smoother deals and better terms. Capitalists must also execute attentive due diligence on properties, evaluating their problem and possible repair work expenses to prevent unforeseen costs.

Connecting with knowledgeable investors can supply insights into successful investment approaches and challenges to stay clear of. A mindful evaluation of the funding's terms, including passion prices and repayment timetables, is crucial to assure the investment remains profitable. By executing these approaches, investors can navigate the complexities of tough cash fundings effectively and improve their overall success in genuine estate investing.

Regularly Asked Questions

What Sorts Of Quality Get Hard Money Loans?

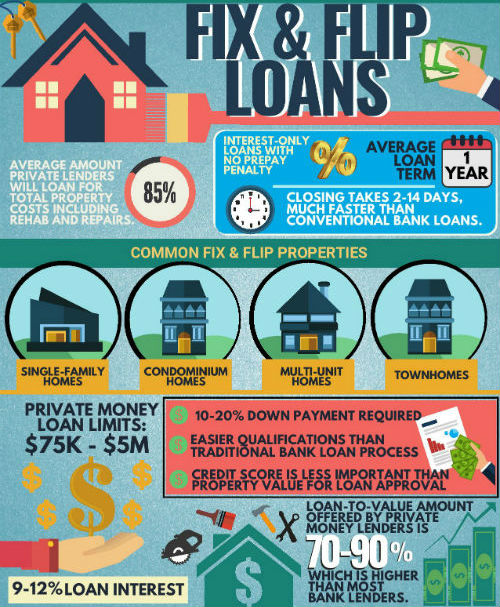

Hard money finances typically qualify residential properties that require fast financing, such as fix-and-flips, business structures, and investment buildings. Lenders primarily take into consideration the residential property's worth instead of the debtor's creditworthiness or earnings.

Just How Rapidly Can I Get Funds From a Tough Money Loan Provider?

The speed of receiving funds from a difficult money lender generally ranges from a couple of days to a week. Georgia hard money lenders. Variables affecting this duration include home assessment, paperwork efficiency, and the lending institution's functional performance

Are Hard Cash Financings Readily Available for Non-Investment Feature?

Difficult money loans are primarily created for financial investment buildings, however some lenders might think about non-investment homes under particular scenarios. Debtors need to inquire directly with lenders to understand certain qualification requirements and conditions.

What Costs Are Typically Related To Tough Cash Finances?

Hard cash car loans commonly involve numerous fees, including source costs, appraisal charges, closing prices, and in some cases prepayment fines. These costs can greatly affect the total cost, demanding careful consideration by possible borrowers.

Can I Re-finance a Difficult Cash Financing Later?

The possibility of refinancing a hard money loan exists, commonly contingent on the residential or commercial property's admiration and customer credentials. This process might facilitate lower rates of interest or much better terms, boosting financial flexibility for the investor.

Hard cash fundings provide a special funding choice for real estate financiers. Tough money financings are specialized financing alternatives largely utilized by actual estate capitalists. Safeguarding fast accessibility to funds is a key advantage for genuine estate capitalists seeking tough cash loans. Actual estate financiers typically face time restraints, temporary financing remedies like difficult money loans supply a sensible alternative to fulfill prompt funding needs. Investors might seek hard money lendings for quick access to capital, particularly in competitive actual estate markets where timely offers are crucial.